Investment

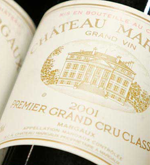

Wine investments are generally low reciprocal relation with other financial securities, have low-medium risk profile, do not raise Capital Gains Tax -the UK Customs regard those as wasting assets or "chattels"- and they are excellent vehicles to yield both high levels of income and capital growth. Demand for fine wines has increased steeply in the last few years. There are more discerning in than ever before and the emerging economies are playing a fundamental role in this change of market trend . Wines sold as futures, is a powerful investment tool to get the most out of your investment yield and high returns .This is really a case of mixing pleasure with profit.

The art of wine investment, as with other commodities, is knowing when to sell and when to hold, and a good wine cellar is, broadly speaking, passively managed. As new vintages are produced and released, known as En Primeur*, stock will be traded to release capital, to enable our clients to purchase at the first release prices. Not every vintage is of a high enough quality to invest, and of those that are, only a small selection of wines will be appropriate for investment Fine wine has shown over time to generate in excess of 11% per annum on average. Always trading with known source.Prices can and do vary over time, but if one purchases very wisely, the risks can be minimized. Great wine is always in demand and Wine appreciates in value because it is constantly being consumed.

*Wine in primeur mean wine bough before bottled

.jpg)

For more information on the wine market ,visit our pages:

Compare the market- Disadvantage of wine investment - Unscrupulous wine supplies - Capital against tax - Wine market and the wealth