Why Invest in Wine

10 Reasons

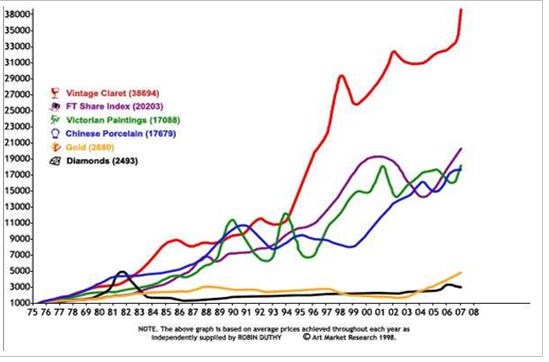

- History of Returns outperforms equity and commodity markets over 25- 50 years – 12%-18%+ annualized.

- Low Volatility compared to other assets.

- Traded Physical Asset – hedge against inflation.

- Low initial cost in small units (cases / bottles). Can be sold of in parts.

- Supply of finite production decreases over time while quality increases.

- Growth of collecting and consumption from Asia, Russia, India and Brazil from new status conscious millionaires.

- Increased demand from wine funds, banks and investors.

- Transportable from areas of low demand to high demand.

- Inefficient market with pricing tiers. creates arbitrage opportunity.

- Enjoyment – drink profits, build relationships, travel and study the craft and history of wine.

1 Chart

- The chart 1975 to 2008 below, compare art market, gold, diamonds and FT share index to the fine wine.

All investors are advised that historical wine investment performance is no guarantee of profits. In addition, all investors are strongly advised to conduct their own independent research and seek professional advice before making a purchase decision.