Capital Against Tax

Wine is not subject to UK capital Gains Tax as the authorities look upon it as a wasting asset, so any profit derived belongs to the client.As well as not being liable to either income tax or capital gains tax, inheritance tax is only paid on the value of the original purchase price.

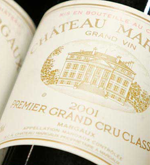

As long as wine is held in the name of a private individual, who is not a wine dealer or trader, under current UK taxation rules, the Inland Revenue does not consider that holding a fine wine stock generates an income. Wines are also not subject to capital gains tax as the Inland Revenue considers them to be a "wasting asset". Once again, the wine must be held by a private individual not connected to the wine trade and the definition of a "wasting asset" is an asset that's useful life is not likely to exceed 50 years. As most wines reach their peak of maturity between 25 and 40 years, it would be very difficult to argue that they have a useful life of over 50 years.

If a particular wine is not a wasting asset, then any gain accruing on its disposal may nevertheless be exempt where the disposal of the proceeds for that single bottle does not exceed £6,000, section 262(1) TGGA. Where, however, a number of bottles are sold to the same person in one or more transactions, then the question might arise as to the whether the bottles themselves constitute a 'set'. If they do, the £6,000 limit would apply to the overall sales proceeds rather than the price fetched for any individual bottle, Section 262(4) TGGA. This is a question of fact that would depend on:

a) Whether the bottles are 'similar and complementary' which would require the wine in them to have been produced from the same vineyard in the same vintage year, and

b) Whether the bottles are of greater worth when sold collectively than when sold individually